Delving into the world of stock trading platform comparison, this article aims to provide a detailed analysis of the key factors to consider when choosing the right platform. From user experience to fees and commissions, we cover it all in this informative piece.

Factors to Consider when Comparing Stock Trading Platforms

When comparing stock trading platforms, there are several key factors to consider to ensure you choose the platform that best suits your needs and preferences. From features and user experience to fees and commissions, each aspect plays a crucial role in your overall trading experience.

Key Features to Look for in a Stock Trading Platform

- Access to a wide range of investment options, including stocks, ETFs, mutual funds, and more.

- User-friendly interface with customizable layouts and tools for technical analysis.

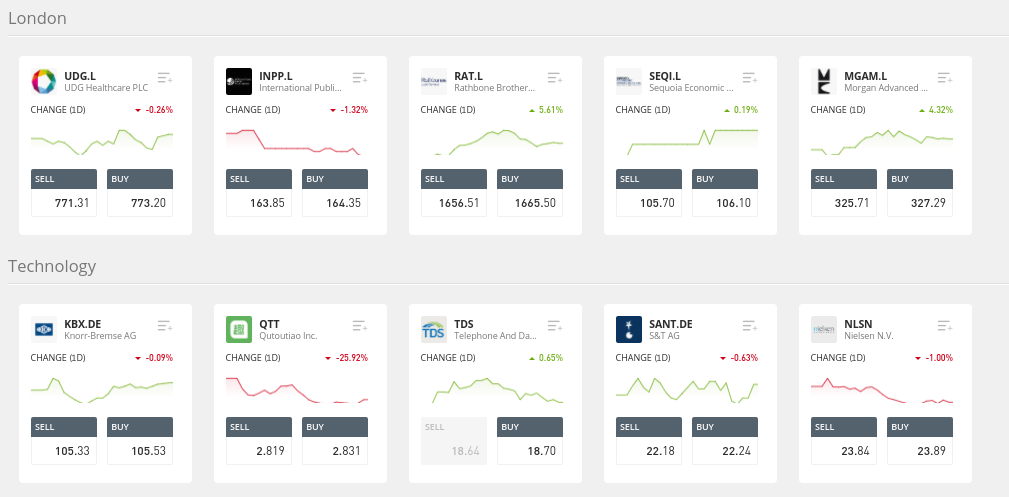

- Real-time market data and research tools to make informed trading decisions.

- Mobile trading capabilities for on-the-go access to your portfolio.

- Security measures to protect your personal and financial information.

The Importance of User Experience in Choosing a Platform

Having a seamless user experience is essential when it comes to trading stocks. A platform that is easy to navigate, offers quick order execution, and provides access to relevant information can make a significant difference in your trading success. User-friendly interfaces and intuitive design can help you focus on making informed decisions rather than struggling with the platform itself.

Comparing Fees and Commissions Charged by Different Platforms

- Look for platforms with competitive commission rates and fee structures that align with your trading frequency and budget.

- Consider additional charges for services like margin trading, account maintenance, or access to premium features.

- Be aware of any hidden fees or fine print that may impact your overall trading costs.

- Compare fee structures across platforms to find the best value for your trading needs.

Types of Stock Trading Platforms

When it comes to stock trading platforms, there are several types available to investors. Each type offers different features and benefits, catering to various trading styles and preferences.

Online Brokers

Online brokers are platforms that allow investors to buy and sell stocks through a web-based interface. They offer a wide range of tools and resources for trading, including research reports, real-time quotes, and educational materials. Some popular online brokers include E*TRADE, TD Ameritrade, and Charles Schwab.

Mobile Apps

Mobile trading apps are specifically designed for trading on the go, allowing investors to access their accounts and place trades from their smartphones or tablets. These apps are convenient and offer features like real-time quotes, news alerts, and customizable watchlists.

Examples of popular mobile trading apps include Robinhood, Webull, and TD Ameritrade Mobile.

Desktop Platforms

Desktop platforms are advanced trading software that offers powerful tools and features for active traders. These platforms are highly customizable and often include advanced charting capabilities, technical analysis tools, and automated trading options. Some well-known desktop platforms include thinkorswim, MetaTrader, and Interactive Brokers.

Platform Security and Regulation

In the world of stock trading, platform security and regulation play a crucial role in ensuring the safety of investors' funds and information. Understanding the importance of these factors can help traders make informed decisions when choosing a stock trading platform.

Importance of Platform Security

Platform security is essential to protect investors' sensitive data, such as personal information and financial details, from cyber threats and potential breaches. A secure platform helps maintain the integrity of transactions and prevents unauthorized access to accounts.

Regulatory Oversight Impact

Regulatory oversight ensures that stock trading platforms operate within the guidelines set by governing bodies, such as the SEC (Securities and Exchange Commission) in the United States. Compliance with regulations helps maintain transparency, integrity, and fairness in the stock market.

Comparison of Security Measures and Regulations

When comparing stock trading platforms, it is essential to assess the security measures implemented by each platform, such as encryption protocols, two-factor authentication, and regular security audits. Additionally, understanding the regulatory framework that governs each platform can provide insights into their level of compliance and accountability.

Trading Tools and Resources

When comparing stock trading platforms, it is essential to consider the trading tools and resources offered by each platform. These tools can significantly impact your trading experience and success in the market.

Essential Trading Tools

- Real-time market data and quotes

- Charting tools for technical analysis

- Order types such as market orders, limit orders, and stop orders

- Watchlists and alerts for monitoring stocks

- Profit and loss calculators

Research and Analysis Resources

- Access to company financials, analyst reports, and news updates

- Screeners for filtering stocks based on specific criteria

- Technical analysis indicators and overlays

- Market commentary and insights from experts

Educational Resources for Traders

- Video tutorials on trading strategies and platform features

- Webinars and online courses on fundamental and technical analysis

- Articles and blogs covering market trends and investment tips

- Demo accounts for practicing trading without risking real money

Customer Support and Service

Customer support is a crucial aspect to consider when choosing a stock trading platform. The quality of customer service and the responsiveness of the support team can greatly impact your trading experience. Let's delve into the customer support options available on various stock trading platforms and compare their service quality.

Customer Support Options

- Phone Support: Some platforms offer phone support for immediate assistance.

- Email Support: Email support is common for non-urgent queries or concerns.

- Live Chat: Live chat support allows for real-time interactions with customer service representatives.

Service Quality Comparison

- Platform A provides 24/7 phone support, ensuring quick resolution of issues.

- Platform B offers email support with an average response time of 24 hours.

- Platform C stands out for its responsive live chat feature, allowing users to get instant help.

Responsiveness and Availability

It's essential to assess how quickly customer support responds to queries and whether they are available during trading hours.

- Platform X's support team is available 24/7, ensuring assistance at any time of the day or night.

- Platform Y guarantees a response within 2 hours during market hours, enhancing user experience.

- Platform Z offers limited support hours, which might be a drawback for traders in different time zones.

Final Review

In conclusion, navigating the realm of stock trading platforms can be daunting, but armed with the knowledge from this guide, you're better equipped to make informed decisions. Whether you're a novice or seasoned trader, understanding these nuances is crucial for success in the market.

Clarifying Questions

What are the key features to look for in a stock trading platform?

Some key features to consider include ease of use, research tools, real-time data, and security protocols.

How does regulatory oversight impact stock trading platforms?

Regulatory oversight ensures that platforms adhere to industry standards, protecting investors and maintaining market integrity.

What types of trading tools should a platform offer?

Essential trading tools include charting capabilities, order types, market analysis tools, and customizable watchlists.