Delve into the dynamic world of MCX Gold & Silver Market Price Live Updates, where every fluctuation matters. Explore the intricacies of these precious metal markets and how real-time updates shape trading decisions for investors and traders alike.

Uncover the interplay between market trends, economic factors, and geopolitical events that influence the prices of gold and silver, providing a comprehensive understanding of this ever-evolving landscape.

Overview of MCX Gold & Silver Market

MCX (Multi Commodity Exchange) is a leading commodity exchange in India where trading of various commodities, including gold and silver, takes place. Gold and silver are considered precious metals and are highly sought after for their value and investment potential.

The Significance of Gold and Silver Markets

The gold and silver markets play a crucial role in the global economy as they are seen as safe-haven assets during times of economic uncertainty. Investors often turn to gold and silver as a hedge against inflation and market volatility.

The prices of gold and silver are influenced by various factors such as supply and demand, geopolitical events, and economic indicators.

Impact of Live Updates on Trading Decisions

Live updates on MCX Gold & Silver market prices provide traders and investors with real-time information on price movements, enabling them to make informed decisions. By monitoring live updates, traders can analyze market trends, identify opportunities, and execute timely trades.

This real-time data helps in minimizing risks and maximizing profits in the volatile gold and silver markets.

Factors Influencing Gold & Silver Prices

The prices of gold and silver are influenced by a variety of factors that can impact their value in the market. Understanding these key factors is essential for investors and traders looking to make informed decisions.

Global Economic Trends

Global economic trends play a significant role in determining the prices of gold and silver. During times of economic uncertainty or instability, investors often turn to precious metals as a safe haven asset. This increased demand can drive up the prices of gold and silver.

On the other hand, when the economy is strong and stable, the demand for these metals may decrease, leading to lower prices.

Geopolitical Events

Geopolitical events such as wars, political unrest, or trade disputes can have a major impact on the prices of gold and silver. These events can create uncertainty in the market, prompting investors to seek out safe assets like gold and silver.

As a result, the prices of these metals may increase during times of geopolitical turmoil. Additionally, any disruptions in the supply chain due to geopolitical events can also affect the prices of gold and silver.

Importance of Live Price Updates

Real-time updates in the gold and silver market play a crucial role in helping traders and investors make informed decisions. These live price updates provide up-to-the-minute information on market trends, enabling stakeholders to react swiftly to changing conditions.

Utilizing Live Price Updates for Decision Making

- Traders rely on live price updates to monitor price movements and identify potential entry and exit points for their trades.

- Investors use real-time data to assess the market sentiment and make strategic decisions regarding their investment portfolios.

- Armed with current price information, market participants can implement risk management strategies and adjust their positions accordingly.

Role of Technology in Providing Accurate Live Updates

- Advanced trading platforms and financial websites leverage technology to deliver accurate and timely price updates to users.

- Automated algorithms and data feeds ensure that live price information is reliable and reflects the latest market conditions.

- Real-time charts and analysis tools empower traders and investors to interpret price movements and make well-informed decisions.

Analysis of Price Trends

When looking at the historical price trends of gold and silver, we can observe patterns and cycles that have repeated over time. Analysts often use price trend analysis to forecast future movements in the market.

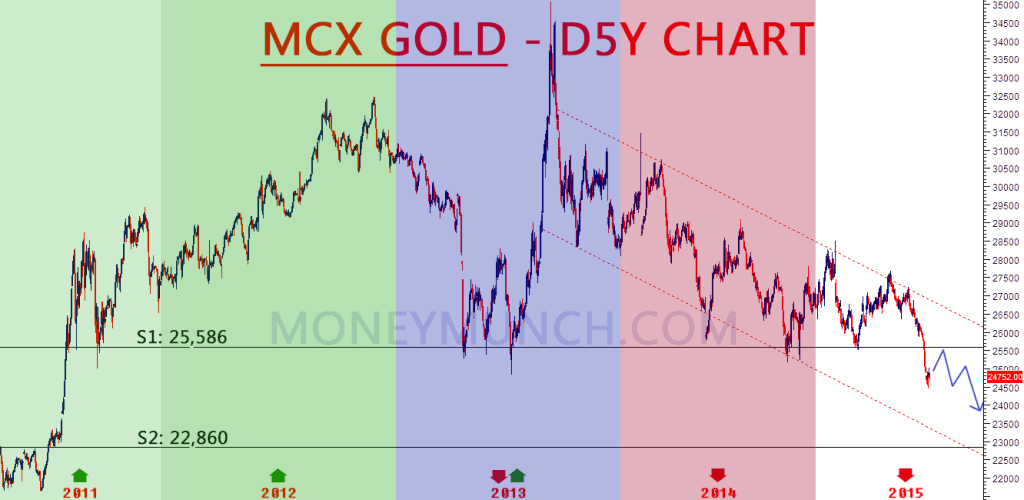

Comparison of Historical Price Trends

- Gold: Over the past few decades, gold has shown a tendency to increase in value during times of economic uncertainty or inflation. There have been periods of rapid growth followed by corrections, but the overall trend has been upward.

- Silver: Unlike gold, silver prices tend to be more volatile and are influenced by both industrial demand and investment trends. The price of silver has experienced significant fluctuations over the years.

Identifying Patterns and Cycles

- Analysts look for repetitive patterns in price movements, such as seasonal trends or long-term cycles. These patterns can help them predict potential turning points in the market.

- Some common patterns include head and shoulders formations, double tops or bottoms, and trend lines that indicate support or resistance levels.

Using Price Trend Analysis for Forecasting

- By analyzing historical price trends, analysts can make educated guesses about future price movements. They use technical indicators, chart patterns, and other tools to identify potential entry or exit points in the market.

- Price trend analysis is not foolproof, but it can provide valuable insights for traders and investors looking to make informed decisions based on market trends.

Summary

In conclusion, navigating the MCX Gold & Silver Market Price Live Updates requires a keen eye for detail and a deep understanding of the factors driving price movements. Stay informed, stay ahead, and make informed decisions in this fast-paced market environment.

Top FAQs

How often are the MCX Gold & Silver Market prices updated?

The prices are updated in real-time, providing traders and investors with the most current information for making informed decisions.

What role does technology play in providing live updates for MCX Gold & Silver Market?

Technology plays a crucial role in delivering accurate and timely updates, ensuring that market participants have access to the latest price movements.

Are there any specific patterns or cycles in the historical price trends of gold and silver?

Analysts often identify recurring patterns or cycles in the market prices, which can be used for forecasting future price movements.